Unless you have been living under a rock, you have likely heard about the UK ‘Energy Crisis’ recently…

So, why is no one panicking?

In a time of sensationalist media and polarising politics, we as a nation have become desensitised to such strong language. It seems like every other day there is a national emergency, Armageddon, or disaster.

But let’s be clear about something.

This absolutely is a crisis.

It is not a poor choice of words or an attempt to sell more newspapers. Businesses are shutting their doors for good, employees being let go in the hundreds, and customers being affected in the millions.

So, what happened, what is happening, and what is going to happen?

The perfect recipe for disaster

Since January, wholesale gas prices have increased by 250%. Even more recently, gas prices have surged by 70% since August. Many energy companies struggling to survive, some even going bust. Both small and large energy suppliers are facing massive challenges, which will likely have an impact on consumers.

The UK Government has been holding emergency talks with Ofgem and suppliers, with many are worried about the upcoming winter.

It is no one thing that has caused this crisis, rather a collection. We will outline some of the main causes below:

Cold Winters

Last year was a cold winter in Europe, adding extra pressure on supplies. This has resulted in lower levels of stored gas than usual. Gas storage in Europe is 22.9 billion cubic metres under normal levels, with experts predicting Europe cannot catch up.

When you combine Britain and European countries, gas storage is roughly 72% full. However, this time last year, gas storage was 94% full. This drop is significant compared to the average over the last 10 years of 85% full, according to Gas Infrastructure Europe data.

China’s recovery

China are well-known to be a key driver of global market prices.

The post-COVID ramp up in production has coincided with an increase in demand from across Asia and Europe too. This creates a situation where many economies recovering from the fallout of the pandemic are left scrambling to source new supplies.

Market experts at S&P Global Platts stated earlier this year that they expected China’s demand for gas to rise to 360 billion cubic meters, up 8.4% from last year. In order to satisfy this record demand for gas, China imports via the use of super-chilled tankers.

Russian gas

As many shipments of gas have been turned to the East instead of the West, flows from Russia have failed to meet the shortfall. Russia’s state-backed gas company, Gazprom, refused to increase their European exports – despite the record prices.

Although Gazprom have met their contractual obligations for gas delivery into Europe, there are many that believe they have done next to nothing to ease the situation.

Generation gap

Many older UK nuclear power plants have been forced to shut temporarily for maintenance as well as a hugely important power cable from France to England being forced to shut down after a fire. Add into the mix the fact that wind turbines have slowed due to a lack of wind and you can see why there is so much pressure.

In order to make up for the lack of gas-storage capabilities across the UK (Less than 1% of gas storage in Europe is held by the UK) the UK has been forced to temporarily fire up coal power stations.

Uncapped entry and small suppliers

One of the reasons as to why suppliers are left so vulnerable is largely thanks to the lack of barriers to entry into the energy market. Many barriers to entry were dropped in 2014 to add some much-needed competition for the Big6, rapidly increasing the number of UK suppliers.

However, much of the financial stress-testing maybe wasn’t as rigid as it should have been, and has contributed to the scenario we are in just now. As costs are rapidly rising for suppliers well-above the arranged market price-cap, the only ones able to withstand this climate are the vast suppliers with deep pockets.

What energy suppliers have gone bust and where are the customers going?

Recent update: As of today 29th September 2021, three more suppliers have gone bust – Enstroga, Igloo Energy, and Symbio Energy. Although together these three companies represent less than 1% of the UK energy market, 233,000 customers will be moved to other suppliers.

With so many energy suppliers going bust, there is a serious number of customers being shifted around. This looks set to only get worse.

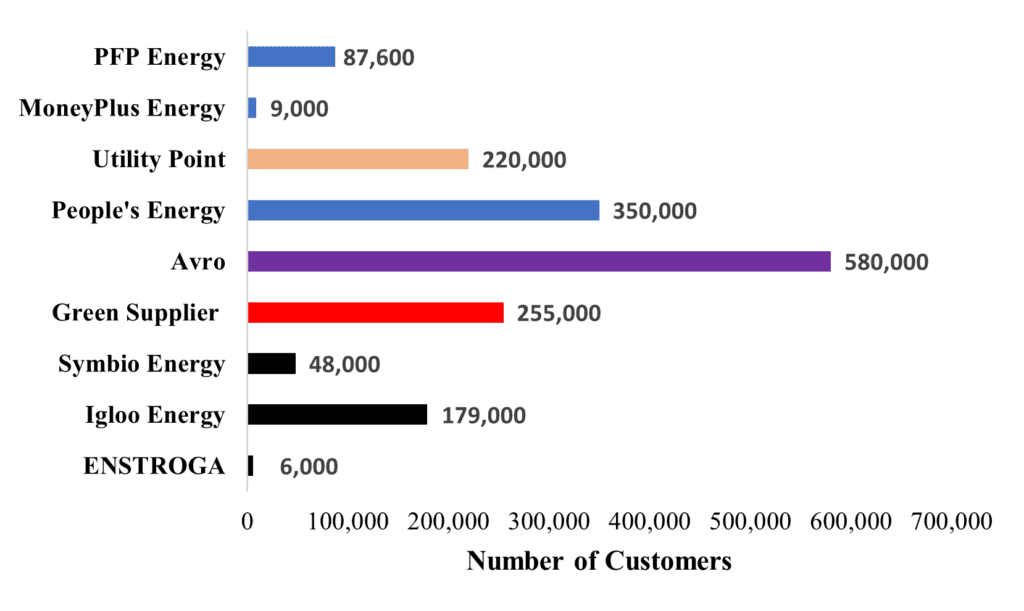

By looking at Ofgem press releases, we have created the following graph from published figures. All customer numbers are approximations, but give an astonishing insight into how widespread this crisis truly is.

The customers from PFP Energy, MoneyPlus Energy, and People’s Energy will be served by British Gas from the 11th, 12th, and 19th of September respectively. This is a rough total of 446,000 customers.

The 220,000 Utility Point customers will be served by EDF from the 18th of September, 580,000 customers from Avro will move to Octopus Energy on the 26th of September, and 255,000 customers from Green Supplier will be moved to Shell Energy on the 27th of September.

Although it has been announced that a total of 233,000 customers will be affected by Symbio Energy, Igloo Energy, and ENSTROGA going bust – there has not been any further announcements where these customers will go. This information will likely be released in the coming days.

What does this mean for customers?

Just because your energy supplier has gone bust does not mean that you will be left without gas or electricity.

Customers will look to Ofgem, who will handle the transfer to new suppliers. The process for this is usually a few weeks.

In most cases, it is advisable to wait until your energy supplier contacts you. When this happens, they will explain exactly what will happen to your account and who your new supplier is. If you don’t hear from anybody within two weeks of the change, then you can check who has taken over your energy supply by clicking here.

It is definitely realistic to assume that if your energy supplier goes bust that you will be switched to a more expensive contract. Unfortunately, there is not an awful lot customers can do about this. The market price cap will shelter consumers from the worst of the skyrocketing markets, but not entirely.

What now?

Well, expect more of the same news.

With the days getting shorter and evenings getting longer, temperatures dropping and the feel of a slightly chillier breeze – it is likely that the arrival of winter will only exacerbate the situation.

Although the UK government have ‘discussed’ emergency loans to suppliers, there has been little else in the way of support offered. As it stands, the only people who look set to benefit are those with large enough cash reserves to withstand the pressure and sponging up customers from bust businesses.

This crisis has exposed some extreme vulnerabilities within the UK energy industry – much as a result of the uncapped entry into a capped market. It is again realistic to assume that much of the progress in the way of additional competition from deregulation will be washed away.

Niccolo Gas – Energy Experts just a call away

Many businesses are (astonishingly) still in the dark as to how hiring a business gas specialist could benefit their company.

By partnering with Niccolo Gas as your commercial gas customer, you instantly gain extensive industry knowledge and reliable service, access to a range of business gas products that are suited to businesses of all types, dedicated services from one of our local teams.

All of this on top of a huge reduction in your business costs.

Unlike some suppliers, we actually want to talk to you – so get in contact today!

Call us: 0131 610 8868

Email us: info@niccolo.co.uk

Submit a webform: Click Here

We look forward to hearing from you!

Comments are closed.